8 Common Property Management Mistakes You Must Avoid

Owning a rental property in Dubai’s dynamic market can be incredibly rewarding, but navigating the complexities of property management is crucial for success. Many landlords, especially those new to the scene or managing properties from afar, inadvertently make costly errors. Avoiding common pitfalls such as inadequate tenant screening, neglecting regular maintenance, or misunderstanding local regulations can significantly impact your return on investment and peace of mind. This guide highlights 8 frequent property management mistakes and offers actionable insights to help you optimize your Dubai property investment, ensuring it remains a valuable and hassle-free asset. For expert assistance in making the most of your venture, consider partnering with seasoned professionals like West Gate Dubai.

Why Effective Property Management is Non-Negotiable in Dubai

Dubai’s real estate landscape is unique – it’s fast-paced, attracts a diverse international tenant base, and operates under a specific legal framework governed by the Real Estate Regulatory Agency (RERA). Effective property management isn’t just about collecting rent; it’s about maximizing your ROI, minimizing vacancies, ensuring legal compliance, and preserving the value of your property. Poor management can quickly turn a promising investment into a source of stress and financial drain. Understanding why Dubai is a global leader in real estate investment also underscores the importance of professional management to maintain a competitive edge.

The 8 Common Property Management Mistakes (and How to Sidestep Them)

Let’s delve into the common errors that can trip up even well-intentioned landlords and how to steer clear of them.

1. Inadequate Tenant Screening: The Risky Gamble

- The Mistake: One of the most frequent and damaging mistakes is rushing the tenant screening process or not being thorough enough. This includes failing to conduct comprehensive background checks covering credit history, employment verification, and references from previous landlords. The allure of quickly filling a vacancy can lead to accepting the first applicant without due diligence.

- The Impact: This gamble can result in problematic tenants who consistently pay rent late (or not at all), cause damage to your property, or violate lease terms, leading to financial losses, legal headaches, and significant stress.

- The Solution: Implement a rigorous and consistent screening process for every applicant. This should involve a detailed application form, credit checks through authorized channels, verification of income (usually requiring pay stubs or bank statements), and contacting previous landlords to inquire about payment history and behavior. Don’t just take references at face value; ask specific questions. For more insights, explore these 10 tips for finding the perfect tenant. For a deeper dive, understanding how to conduct effective tenant screening in Dubai is crucial.

- External Link: Reputable sources like the Consumer Financial Protection Bureau (CFPB) offer guidance on understanding credit reports, which is a key part of screening.

2. Neglecting Regular Property Maintenance: A Costly Oversight

- The Mistake: Putting off routine maintenance and minor repairs is a classic blunder. Landlords might try to save money in the short term by ignoring small issues, but these often escalate into major, far more expensive problems down the line.

- The Impact: Deferred maintenance leads to a decline in property value, tenant dissatisfaction (increasing turnover), and eventually, significantly higher repair bills. Ignored issues can also become safety hazards, leading to potential liability.

- The Solution: Proactive maintenance is key. Develop a schedule for regular property inspections (e.g., bi-annually) to catch issues early. Address tenant repair requests promptly and professionally. Build a network of reliable and licensed contractors. It’s also wise to budget a certain percentage of your rental income for ongoing maintenance and unexpected repairs. As the old adage goes: “An ounce of prevention is worth a pound of cure.”

This is especially true for property upkeep. Learn more about how to manage your property’s maintenance and repairs.

3. Poor Communication with Tenants: Building Walls, Not Bridges

- The Mistake: Lack of clear, timely, and professional communication with tenants is a common source of friction. This can manifest as being unresponsive to queries or concerns, providing unclear information, or failing to document important interactions.

- The Impact: Poor communication breeds tenant dissatisfaction, misunderstandings, and disputes, often leading to higher tenant turnover rates and a negative reputation.

- The Solution: Establish clear communication channels and expectations from the outset. Be responsive and professional in all dealings. Keep a written record of important communications, such as maintenance requests or lease discussions. A well-drafted tenant handbook can be invaluable, outlining procedures and expectations clearly.

4. Misunderstanding Landlord-Tenant Laws: Navigating Murky Waters

- The Mistake: The Dubai rental market is regulated, and ignorance of these laws is no excuse. Common errors include not knowing RERA regulations, failing to register tenancy contracts with Ejari, misunderstanding legal eviction procedures, or incorrectly applying rent increase caps.

- The Impact: Non-compliance can lead to hefty fines, void lease agreements, difficulties in resolving disputes, and even legal action.

- The Solution: Educate yourself on Dubai’s landlord-tenant laws. The Dubai Land Department (DLD) and RERA websites are official sources of information. Ensure all tenancy contracts are registered with Ejari. Understand the legal grounds and procedures for eviction and rent increases. For complex situations, seeking legal advice or using a knowledgeable property manager is advisable. Our Dubai legal guide for real estate can also offer valuable insights.

5. Setting Incorrect Rental Rates: Leaving Money on the Table or Scaring Tenants Away

- The Mistake: Pricing your property incorrectly – either too high or too low – is a frequent misstep. Overpricing can lead to extended vacancies, while underpricing means you’re not maximizing your potential rental income.

- The Impact: Both scenarios result in financial loss. Long vacancies mean no income, while underpricing directly impacts your ROI.

- The Solution: Conduct thorough market research. Analyze current rental rates for comparable properties in your area (considering size, condition, amenities, and location). Stay informed about market trends and seasonality. Tools like the RERA rental index can provide guidance. Adjust your rates strategically to be competitive yet profitable. If you’re unsure, consulting with real estate professionals who understand how to set rent prices for your properties can be beneficial. FeatureProperty A (Yours)Comparable 1Comparable 2Market AverageBedrooms222Area (sq. ft.)1,2001,1501,250ConditionGoodExcellentFairRent (AED/year)To be determined95,00085,000~90,000 This table is a simplified example for illustrative purposes.

6. DIY Property Management (When You Lack Time or Expertise)

- The Mistake: Many investors, particularly those with other full-time commitments or living overseas, underestimate the significant time, effort, and specialized knowledge required for effective property management.

- The Impact: Attempting to do it all yourself without adequate resources can lead to burnout, costly mistakes across all the areas mentioned above, missed opportunities for optimization, and ultimately, a stressful and unprofitable investment experience.

- The Solution: Honestly assess your availability, expertise, and willingness to handle the day-to-day demands of property management. If you’re stretched thin or unfamiliar with the local market intricacies, hiring a professional property management company is often the wisest decision. The fees paid to a good manager can be easily offset by avoiding costly errors, securing better tenants, and ensuring consistent rental income. Explore the 6 reasons why you should hire a property management company and learn how to choose the right one. This is where West Gate Dubai’s Property Management services can provide immense value.

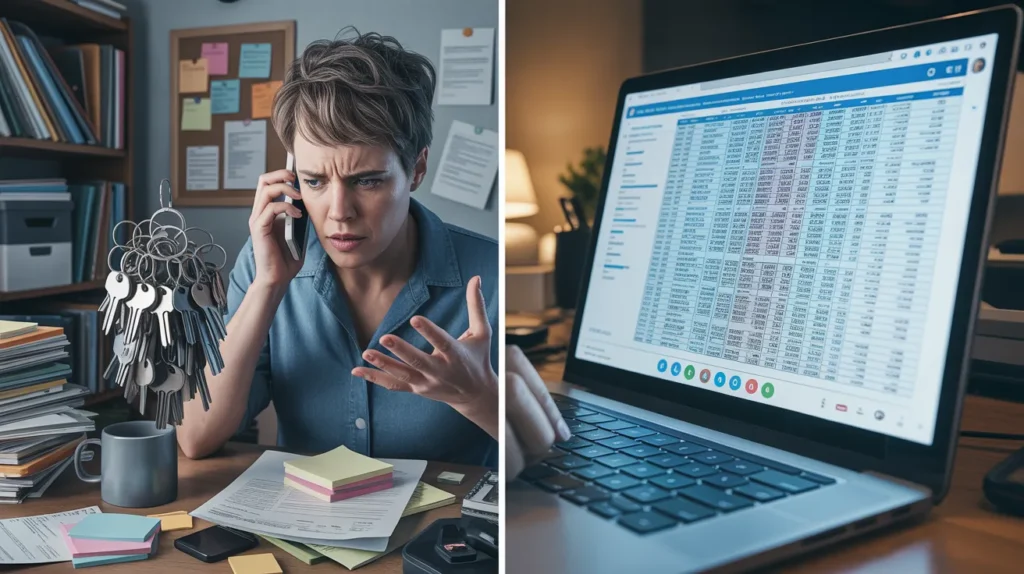

7. Failing to Keep Meticulous Records: A Recipe for Confusion

- The Mistake: Not maintaining organized, detailed, and accurate records of all property-related transactions and communications.

- The Impact: This can create significant problems when tracking financial performance, preparing for tax season, or if disputes arise with tenants. Lack of proper documentation can weaken your position in legal situations.

- The Solution: Implement a robust record-keeping system from day one. This can be specialized property management software or even a well-organized system of digital and paper files. Key records to maintain include:

- Signed lease agreements and any addendums

- Rent payment receipts and a clear rent ledger

- All invoices and receipts for maintenance and repairs

- Property inspection reports (ideally with photographic/video evidence)

- Copies of all official notices and tenant communication logs

- Property insurance policies and related documents

8. Ignoring Tenant Retention Strategies: The Revolving Door Problem

- The Mistake: Focusing heavily on tenant acquisition while neglecting strategies to retain good, existing tenants.

- The Impact: High tenant turnover is expensive. Costs include advertising for new tenants, cleaning and preparing the property between occupancies, and potential income loss during vacancy periods.

- The Solution: Good tenants are valuable assets. Foster positive landlord-tenant relationships by being responsive, fair, and respectful. Address maintenance issues promptly. When a lease is nearing renewal, communicate in advance and consider offering fair terms or even small incentives for renewal. A well-maintained property and a professional attitude go a long way in encouraging tenants to stay longer. For more ideas, research tenant retention best practices from authoritative sources like the National Apartment Association (though focused on the US, many principles are universal).

Partnering for Success: How West Gate Dubai Elevates Your Property Management

Navigating the complexities of the Dubai property market and avoiding these common mistakes requires diligence, expertise, and time. At West Gate Dubai, our dedicated property management services are designed to take the burden off your shoulders and ensure your investment performs optimally.

We leverage our deep understanding of the Dubai market, implement rigorous tenant screening processes, manage proactive maintenance schedules, ensure full legal and RERA compliance, and employ strategic marketing to keep your property occupied with reliable tenants. Our goal is to maximize your return on investment while providing you with complete peace of mind.

Whether you are looking to invest in properties for sale in Dubai or need expert management for your existing portfolio, including finding quality tenants for your properties for rent in Dubai, West Gate Dubai is your trusted partner. We are committed to maximizing your investment in rental property through proven strategies for success.

Conclusion: Secure Your Dubai Investment by Avoiding These Pitfalls

Effective property management is the cornerstone of a successful real estate investment in Dubai. By understanding and proactively avoiding these eight common mistakes, you can significantly enhance your rental income, protect your asset, and enjoy a more profitable and less stressful experience as a landlord.

Don’t let preventable errors diminish the potential of your Dubai property. Take informed steps, or better yet, partner with experts who can navigate the landscape for you.

Ready to transform your property management experience? Contact West Gate Dubai today for a consultation and discover how we can help your investment flourish.