REITs in Dubai: An Alternative Way to Invest in the Property Market

Looking for a hands-off, diversified, and affordable way to tap into Dubai’s booming real estate market? Real Estate Investment Trusts (REITs) offer investors a unique opportunity to earn regular income and benefit from property appreciation—without the hassle of direct ownership or management. Discover how Dubai REITs can transform your investment strategy and why they’re fast becoming the preferred choice for savvy investors in 2025.

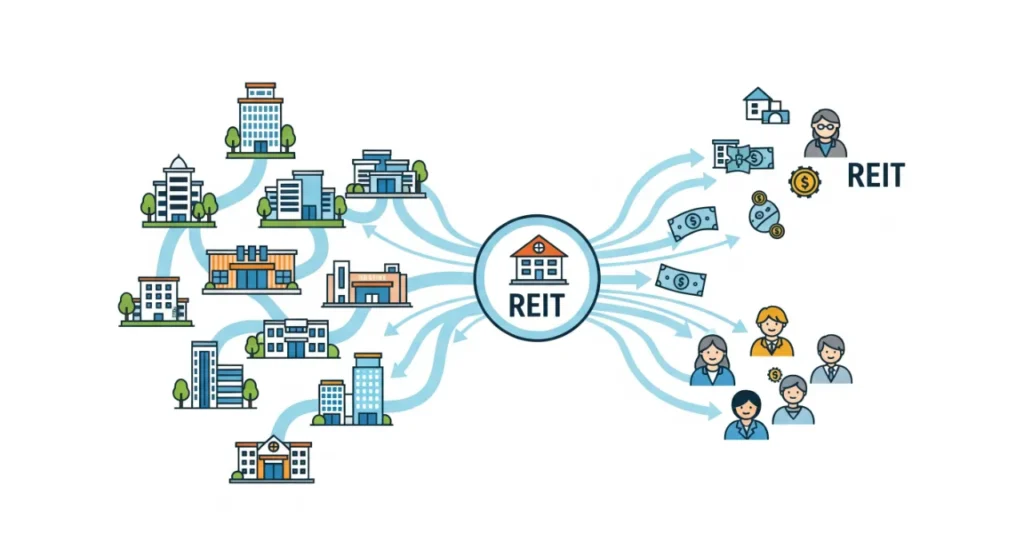

What Are REITs and How Do They Work in Dubai?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. In Dubai, REITs are regulated investment vehicles that allow individuals to invest in large-scale, income-generating properties—such as offices, residential buildings, and shopping malls—by purchasing shares traded on the stock market.

Key Features of Dubai REITs:

- Diversification: Invest in a portfolio of properties, reducing risk compared to buying a single unit.

- Liquidity: Buy and sell REIT shares easily on exchanges like NASDAQ Dubai and Dubai Financial Market (DFM).

- Regular Income: REITs must distribute at least 80% of their net profits as dividends, offering steady cash flow.

- Low Entry Barrier: Start with a modest investment—no need for large upfront capital.

- Professional Management: Properties are managed by experts, saving investors time and effort.

Why Choose REITs Over Direct Property Investment?

| Factor | REITs in Dubai | Direct Property Investments |

|---|---|---|

| Capital Required | Low—buy shares from as little as a few hundred AED | High—typically hundreds of thousands of AED |

| Liquidity | High—shares traded on stock exchanges | Low—selling property can take months |

| Income | Regular dividends (80-90% of net income) | Rental income depends on occupancy and demand |

| Risk | Diversified across many properties | Concentrated in a single asset |

| Management | Fully handled by professionals | Owner responsible for all management tasks |

Top Dubai REITs to Watch in 2025

Dubai’s REIT market is maturing, with several prominent options for investors:

- Emirates REIT: The UAE’s first and largest Sharia-compliant REIT, with a portfolio exceeding $1 billion, including commercial towers and schools.

- ENBD REIT: Managed by Emirates NBD Asset Management, this REIT offers exposure to offices, residential, and industrial properties.

- Al Mal Capital REIT: Listed on the Dubai Financial Market, targeting a net dividend yield of at least 7%.

- Dubai Residential REIT: The GCC’s largest REIT, managing over 35,000 residential units with a 97% occupancy rate as of 2024.

How to Invest in Dubai REITs

- Open an Account: Register with a licensed broker authorized to trade on NASDAQ Dubai or DFM.

- Select a REIT: Research the REIT’s property portfolio, management team, and dividend history.

- Buy Shares: Purchase REIT shares through your brokerage platform—just like buying stocks.

- Monitor Performance: Review financial reports and market trends regularly to optimize your investment.

Benefits of REITs for International Investors

- No Need for UAE Residency: Anyone can invest in Dubai REITs, regardless of nationality.

- Tax Efficiency: REITs enjoy corporate income tax exemptions, and UAE-based investors benefit from tax-free dividends and capital gains.

- Regulatory Oversight: Governed by the Dubai Financial Services Authority (DFSA) and Securities and Commodities Authority (SCA) for transparency and investor protection.

Dubai Property Market Outlook: Why 2025 Is a Great Year for REITs

Dubai’s real estate market is surging, with property prices rising over 20% year-on-year in 2024 and strong demand forecast for 2025. Key growth drivers include:

- Mega-projects and Infrastructure: Areas like Dubai South, Jumeirah Village Circle, and Dubai Creek Harbour are attracting global investors.

- High Rental Yields: Prime locations offer yields of 6–10%, making Dubai one of the world’s most attractive property markets.

- Investor-Friendly Policies: Flexible payment plans, freehold ownership, and a favorable regulatory environment.

How West Gate Dubai Can Help You Succeed

As a leading real estate agency, West Gate Dubai offers end-to-end support for all your property investment needs. Whether you’re seeking expert advice, property management, or the latest listings, our team is here to help you navigate Dubai’s dynamic market.

- Professional Property Management: Let West Gate handle your property—ensuring high occupancy, prompt maintenance, and maximum returns.

- Properties for Rent in Dubai: Explore top rental opportunities in Dubai’s hottest neighborhoods.

- Properties for Sale in Dubai: Discover premium properties for sale, from luxury apartments to family villas.

“Navigating the real estate market can be challenging, but West Gate Dubai made it feel easy and stress-free. Their in-depth market knowledge and commitment to client satisfaction truly set them apart.” — Client Testimonial

Frequently Asked Questions About Dubai REITs

Q: Can foreigners invest in Dubai REITs?

A: Yes, Dubai’s REITs are open to both local and international investors, with no residency requirement.

Q: What are the risks of investing in REITs?

A: Like any investment, REITs carry risks such as market fluctuations and changes in property values. However, diversification and professional management help mitigate these risks.

Q: How do REIT dividends compare to direct rental income?

A: REITs typically offer competitive dividend yields (6–8% in 2025), often higher than average rental yields for individual properties.

Explore More on Dubai Real Estate

For personalized guidance and to start your investment journey, contact West Gate Dubai today.