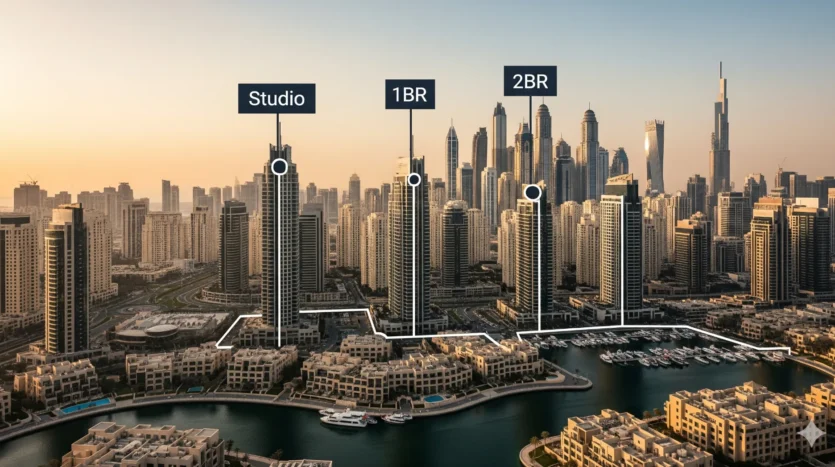

ROI by Property Type 2025: Studios vs 1BR vs 2BR

For Dubai in 2025, studios often deliver the highest gross rental yields, typically in the 7–9% range, while 1BR units average around 6–8% and 2BRs come in closer to 5–7%. Actual ROI varies by community, entry price, service charges, furnishing level, and leasing strategy. The right unit type depends on your budget, risk tolerance, and whether you target cash flow, capital appreciation, or both.

What “ROI by Property Type” means—and why it matters in Dubai

Return on investment (ROI) compares the income and gains from a property to your total costs. In Dubai’s apartment-led market, unit size strongly influences rentability, turnover, costs, and therefore ROI. Studios and compact 1BRs tend to attract a larger tenant pool and can achieve higher yields. Larger 2BRs may provide steadier family demand and lower churn, but usually slightly lower yields.

Two core yield metrics guide decisions:

- Gross rental yield = (Annual rent / Purchase price) * 100%

- Net rental yield = ((Annual rent – Annual operating costs) / Total acquisition cost) * 100%

In 2024 data carried into 2025, implied single-let apartment yields in Dubai averaged around 7.4–7.6% while villas averaged around 5.3–5.5% according to Knight Frank, with apartments generally yielding more than villas in the current cycle Knight Frank Dubai Residential Market Review Q3 2024. Knight Frank also reports residential yields broadly around 5–7% for apartments citywide, with townhouses/villas lower on average Knight Frank Destination Dubai 2025.

Studios vs 1BR vs 2BR: who wins on ROI in 2025?

Dubai’s rental market remains deep and diverse. Here’s how unit sizes typically stack up for apartment investors focused on ROI.

Quick comparison: typical 2025 characteristics

| Factor | Studio | 1BR | 2BR |

|---|---|---|---|

| Typical gross yield | Often 7–9% | Commonly 6–8% | Typically 5–7% |

| Tenant profile | Singles, young professionals, new arrivals | Couples, professionals, small households | Families, sharers, long-term expats |

| Turnover & voids | Higher churn; short voids if priced right | Moderate churn; balanced demand | Lower churn; voids vary by community |

| Furnishing impact | Furnished boosts rent materially | Furnished helps, impact moderate | Furnished impact varies; less crucial in some family areas |

| Service charges per sq ft | Similar rate; small units mean lower absolute outlay | Moderate absolute outlay | Higher absolute service charge figure |

| Maintenance cost | Lower absolute cost | Moderate | Higher absolute cost |

| Liquidity | Very liquid in mid-market areas | Broadest demand base | Strong in family-centric, mature communities |

| Appreciation potential | Area-driven; strong in improving zones | Balanced; good in prime lifestyle hubs | Area- and school-driven; steady in family zones |

These are directional averages; the exact numbers depend on micro-location, building quality, and pricing strategy. Citywide apartment yields near 5–7% (and often higher for well-selected units) remain common in Dubai, as noted by Knight Frank’s latest research Knight Frank Destination Dubai 2025 and Q3 2024 Residential Review.

What this means for buyers, sellers, landlords, and investors

- Buyers and long-term investors: If you aim for cash flow and faster payback, small units (studios/compact 1BRs) often make sense. If you value steadier occupancy and tenant longevity, 2BRs in family-centric communities can be attractive.

- Sellers: Clarify the unit’s yield story with recent leases and cost breakdowns. Verified rent history and transparent service charges support pricing.

- Landlords: Your net yield is highly sensitive to operational details—pricing to RERA rent bands, furnishing quality, and maintenance response times.

- Portfolio builders: Consider a barbell strategy—mix studios/1BRs for income and 2BRs in blue-chip areas for stability and potential appreciation.

A practical ROI framework: 9 steps before you buy

Follow this checklist to model your returns with discipline:

- Validate achievable rent

- Use building-level comps and seasonality patterns.

- Price to lease within 2–4 weeks to reduce voids.

- Decide leasing strategy

- Long-term annual rent (simpler, lower turnover) vs licensed short-let (more work, potentially higher gross).

- Calculate gross yield

- Use conservative rent estimates and round up potential voids (e.g., 2–4 weeks/year).

- Itemize ongoing costs

- Service charges, AC and common area costs, insurance, routine maintenance, property management, cleaning, and utilities if landlord-paid.

- Include transaction and regulatory fees

- Dubai Land Department transfer fee is typically 4% of the purchase price, plus trustee/admin items DLD service page noting 4%.

- Mortgage registration if applicable.

- Model net yield

- Apply the net yield formula with a realistic expense budget.

- Stress-test assumptions

- Consider 5–10% rent softening, a one-time repair, or longer voids; confirm the deal still works.

- Assess building fundamentals

- Occupancy mix, management quality, snag history, pending works, and RERA service charge index trends.

- Plan operations

- Decide whether to self-manage or optimize your yield with dedicated property management to cut voids and improve tenant satisfaction.

Common Dubai pitfalls—and how to avoid them

- Underestimating service charges: Studio owners often overlook how fees impact net yield. Always request the latest service charge statement before committing.

- Overpricing in the first 30 days: Void periods destroy net yields. Price to lease quickly, then nudge up on renewal.

- Ignoring legal and fee timelines: Budget for the 4% DLD transfer fee and trustee/admin costs, and align your cash flow with handover and mortgage timelines DLD 4% fee reference.

- Furnishing mismatches: In transient hotspots, well-curated, durable furnishing can lift rents and reduce voids for studios and 1BRs. In family zones, over-investing in décor often won’t pay back.

- Underbudgeted CapEx: Air conditioning, appliances, and light renovations can materially reduce first-year returns. Add a contingency reserve.

- Short-let without full plan: Licensing, building permissions, furnishing standards, and operations must be set up professionally; otherwise, net ROI can trail expectations.

How West Gate maximizes ROI by unit size

We tailor acquisition and management strategies to your unit type and target tenant:

- Studios: Speed-to-market and pricing precision, smart furnishing packages, and professional listing assets to push occupancy. Our end-to-end property management focuses on quick turns and minimal downtime.

- 1BR: Balance of depth and durability. We optimize exposure across channels for quality tenants and manage renewals to minimize churn.

- 2BR: Family demand mapping, school catchments, and community amenities. We position for lower turnover and longer leases.

If you’re exploring new inventory, we also advise on off-plan projects in Dubai where payment plans and first-owner positioning can boost medium-term ROI. For ready units, browse current homes for rent and apartments for sale to match your strategy.

Scenario analysis: a compact case study

Investor A targets high cash flow with controlled risk and buys a well-located 1BR.

- Unit: 1BR, mid-floor, modern tower in a transit-rich lifestyle community.

- Purchase price: AED 1,200,000.

- Achievable annual rent: AED 84,000 (conservative), leasing target < 21 days.

- Annual costs (illustrative):

- Service charges: AED 16,000

- Insurance/misc: AED 1,000

- Routine maintenance reserve: AED 3,000

- Professional management: AED 6,720 (8% of rent)

Gross yield: (84000 / 1200000) * 100 = 7.00%

Net yield: ((84000 – (16000 + 1000 + 3000 + 6720)) / 1200000) * 100 = 4.77%

Optimization paths:

- With a tuned launch price and swift leasing, rent can reach AED 90,000.

- Minor furnishing upgrades and pro photography can improve inquiries and reduce voids.

- Over 2–3 years, renewal uplifts and community improvements can push net yields higher.

This example shows how management choices and pricing discipline shift net ROI—even when gross yields look similar across units.

Advanced tips and 2025 trends to watch

- Apartments continue to outperform villas on yield: Research shows implied single-let apartment yields around the mid-7% area in 2024, while villas trail in the mid-5% range Knight Frank Q3 2024.

- Yield bands by size: Studios often top the chart for gross yield, with 1BRs close behind; 2BRs can catch up in family-first areas with tight supply.

- Off-plan positioning: Favor developers and phases with strong end-user demand and credible handover timelines. Payment plans can lower cash-on-cash timing risk. Explore curated off-plan opportunities.

- Regulatory awareness: Align renewal strategies with rent caps and register new leases correctly. Keep a clean compliance trail on fees and registrations.

- Data-driven leasing: Use building-specific comps and quality listing assets to achieve “first 30 days” velocity at minimal discount.

- Net yield focus: Pay closer attention to all-in costs—service charges, realistic void assumptions, and management.

- Capital appreciation: While this guide focuses on income, many communities with ongoing infrastructure and amenity upgrades can offer long-term value growth.

Measurement: KPIs, tracking, and timelines

Track these metrics to keep ROI on target:

- Gross and net yield, updated after each renewal.

- Days on market (DOM) per vacancy; target < 21 days for studios/1BRs in mid-market areas.

- Occupancy rate and tenant tenure.

- Renewal uplift vs market rent ceiling; avoid overpricing into avoidable voids.

- Maintenance per year as % of rent by unit size.

- Price per sq ft trend for your building and micro-location.

A realistic timeline: In year one, expect slightly lower net yields due to furnishing, snagging, and leasing optimization. Year two onward, with fewer startup costs and better tenant fit, net yields typically stabilize or improve.

Why Partner with West Gate Dubai

West Gate Dubai specializes in matching investors to the right unit type and community, then operating the asset for consistent returns. We bring:

- Data-led unit selection and pricing discipline by micro-location and building.

- Professional marketing, tenant screening, and proactive maintenance to reduce voids.

- Strategic renewal management that balances income growth with occupancy stability.

- Access to pipeline stock, including curated off-plan projects, and ready units for both income and appreciation.

- Full-service operations through our dedicated property management team.

You can browse current apartments for sale and homes for rent. We also have many more properties available off-market and in our wider network; if you’d like tailored options, please fill the form and a professional agent will contact you via our Contact Us page.

FAQs

- Which property type has the best ROI in Dubai in 2025?

- Studios often lead on gross yield (frequently 7–9%), with 1BRs close behind. 2BRs may have slightly lower yields but can offer longer tenancy and lower churn in family-focused areas. Exact outcomes depend on micro-location, price, and execution.

- What’s the difference between gross yield and net yield?

- Gross yield is annual rent divided by purchase price. Net yield subtracts operating costs (service charges, maintenance, management fees, and voids) before dividing by purchase price. Net yield is the better measure of real cash-on-cash performance.

- Are short-term rentals better for ROI than annual leases?

- They can be, in the right buildings and locations, if you manage compliance, pricing, and operations well. However, costs and effort are higher, and income can be more seasonal. Many investors prefer annual leases for simplicity and steadier net returns.

- How much do fees impact returns in Dubai?

- Transaction costs include the DLD transfer fee (typically 4% of price) and trustee/admin items. Annual service charges and maintenance have a material effect on net yields. Model these costs carefully before you buy DLD 4% fee reference.

- How do I reduce void periods?

- Launch at a market-clearing price, use professional photos, respond rapidly to inquiries, and complete minor repairs before viewings. Consider professional property management to streamline tenant placement and renewals.

Call to Action

If you want to balance income and growth in 2025, we’ll help you pick the right studio, 1BR, or 2BR and operate it for consistent results. Explore curated off-plan projects in Dubai or engage our specialist property management to optimize yield. We have a lot more properties available than what’s published; please fill the form on our Contact Us page and a professional agent will contact you promptly.