Dubai Mortgage for Expats 2025: Rates, LTV, Required Salary

Buying property in Dubai as an expat in 2025 is straightforward once you know the rules: most banks lend up to 80% LTV on a first home priced at AED 5 million or less (70% above AED 5 million), off-plan mortgages are capped at 50% LTV, the maximum term is 25 years, and your total monthly debt repayments cannot exceed a 50% debt-burden ratio. Minimum salary requirements vary by bank, but most expats qualify with AED 10,000–15,000 per month and a stable income. Mortgage rates are typically structured as fixed for 1–5 years and then variable, often linked to EIBOR plus a bank margin. For the official LTV and affordability rules, see the UAE Central Bank rulebook, and check live EIBOR benchmarks on the Central Bank’s website for rate context.

Sources for the key rules

- UAE Central Bank mortgage regulations, including maximum LTVs, DBR of 50%, and max 25-year tenor: CBUAE Rulebook

- Live EIBOR benchmarks (used by banks to price variable rates): CBUAE EIBOR rates

- Dubai Land Department mortgage registration fee: 0.25% of the loan amount + AED 290: Dubai Land Department

- Example bank finance limits (non-residents up to 50%): ADCB Home Loans

What counts as a competitive mortgage “rate” in 2025?

Banks in the UAE quote home loans in two common ways: a fixed rate for an initial period (commonly 2–5 years) that later reverts to a variable rate, or a fully variable rate from day one. The variable rate is typically EIBOR plus a fixed bank margin. Because EIBOR moves with monetary policy, always compare both the introductory rate and the “reversion” formula. You can review current EIBOR benchmarks directly on the CBUAE website.

A practical tip: when you compare offers, model your payment not only at today’s rate but also at +2% higher, which is the kind of stress test the Central Bank expects lenders to run under its regulations.

Expat LTV limits in 2025 (how much you can borrow)

The UAE Central Bank sets maximum loan-to-value ratios; banks can be stricter but cannot exceed these caps. For expatriates in 2025, the limits are:

- First home (completed), property value ≤ AED 5 million: up to 80% LTV.

- First home (completed), property value > AED 5 million: up to 70% LTV.

- Second home or investment property (completed): up to 60% LTV.

- All off-plan purchases (any buyer type): up to 50% LTV.

- Maximum loan tenor: 25 years.

- Maximum monthly debt burden ratio (DBR): 50%.

- Max financing amount guideline for expats: up to 7x annual income.

If you are a non-resident expat, many banks cap finance at around 50% LTV with stricter documentation and pricing. Example: ADCB indicates up to 50% for non-residents.

Required salary and eligibility

Most lenders require a minimum monthly salary of AED 10,000–15,000 for expat borrowers, with at least 6–12 months of continuous employment and salary transfer or verifiable income. Your approval hinges on the DBR rule: total monthly debt payments (including the new mortgage) cannot exceed 50% of your gross monthly income. Lenders also check your credit history, employer profile, and visa/residency status.

What this means in practice: a household earning AED 30,000 per month can allocate up to AED 15,000 to all debts combined. If you already pay AED 2,000 on a car loan, your maximum mortgage payment target would be around AED 13,000.

Typical documents you will need

- Passport, Emirates ID, and visa page (or recent entry stamp for non-residents).

- Salary certificate or employment letter, 6–12 months of payslips and bank statements.

- Proof of address and current liabilities (credit cards, personal loans).

- Sale and purchase agreement (SPA) for the property; valuation is arranged by the bank.

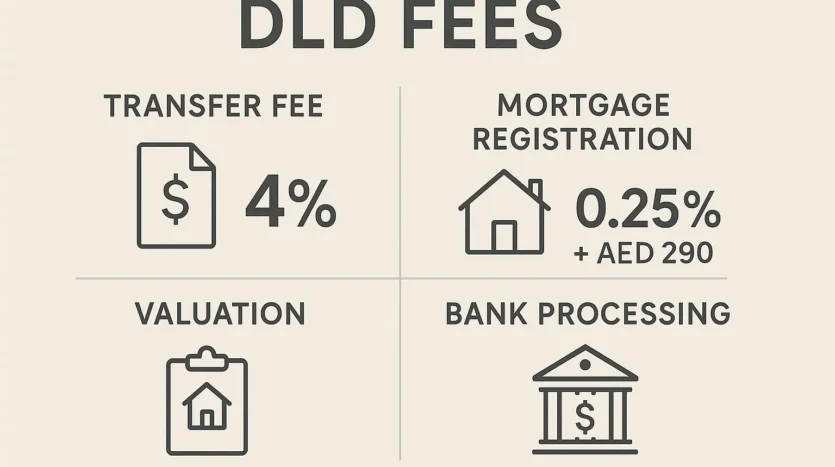

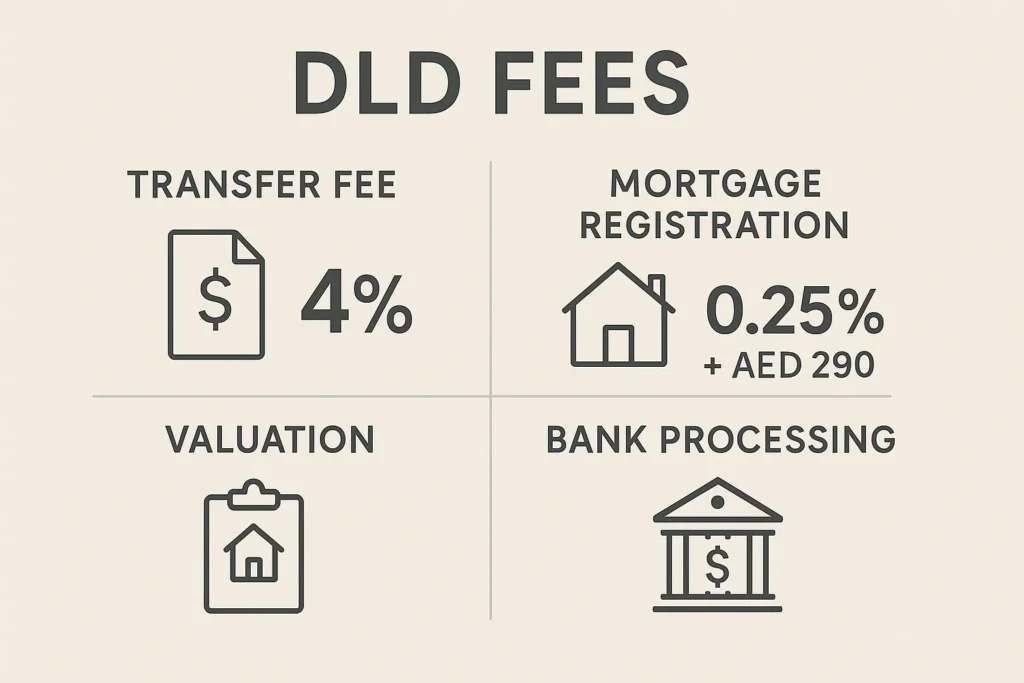

Dubai mortgage fees you should budget for

In addition to your down payment, expect several transactional costs when buying with a mortgage in Dubai. The big three to remember:

- DLD transfer fee: generally 4% of the property price (commonly paid by buyer; sometimes negotiated).

- DLD mortgage registration: 0.25% of the loan amount + AED 290, paid on mortgage registration with DLD.

- Bank costs: valuation (often AED 2,500–3,500+), processing (commonly 0.5–1% of loan), and sometimes a switching/early settlement fee.

Other possible costs include the developer’s NOC, trustee office fees, home insurance, and life insurance if required by the bank.

Quick table: Expat LTVs and key constraints in 2025

| Scenario | Max LTV | Notes |

|---|---|---|

| First home, ≤ AED 5m (completed) | 80% | Standard cap for expats |

| First home, > AED 5m (completed) | 70% | Larger properties need higher equity |

| Second home/investment (completed) | 60% | Applies regardless of property value |

| Any off-plan purchase | 50% | Applies to all buyer types |

| Non-resident expats (typical bank policy) | ~50% | Bank-specific; stricter pricing/docs |

| Max tenor | 25 years | Per Central Bank |

| Debt Burden Ratio | 50% | All debts, including the new mortgage |

Calculating affordability in 2025: a clear example

Let’s say you’re eyeing a ready apartment priced at AED 2,000,000 and you qualify for 80% LTV on a first home.

- Loan amount: AED 1,600,000

- Down payment: AED 400,000 (20%)

- Estimated monthly payment: depends on rate and tenor. If your effective rate were 5.49% and tenor 25 years, your monthly would be around AED 9,900–10,100.

- DBR check: with a household income of AED 30,000 and no other debt, a AED 10,000 mortgage payment keeps you within the 50% DBR limit. If you also have a AED 2,000 car loan, your total debt would be AED 12,000 (40%), which still passes.

Now add estimated fees:

- DLD 4% transfer fee on AED 2,000,000: AED 80,000.

- Mortgage registration fee: 0.25% of AED 1,600,000 = AED 4,000 + AED 290.

- Bank valuation and processing: for example AED 2,500–3,500 valuation, plus up to 1% processing (AED 16,000).

- Trustee, NOC, insurance: allow an additional AED 5,000–10,000 depending on the case.

This is why planning the “all-in” cash needed (down payment plus fees) is as important as modeling your monthly payment.

Fixed vs variable: which is better in 2025?

- Fixed rate (2–5 years): gives payment certainty in the near term; useful while rates are volatile. The drawback is a potentially higher reversion rate if you do not remortgage at the end of the fixed period.

- Variable (EIBOR + margin): usually cheaper at the start if EIBOR is trending down, but your monthly cost can rise if EIBOR increases. Always compare the full pricing formula. Check live benchmarks at the CBUAE EIBOR page.

A common, balanced approach in Dubai is a short fixed period (e.g., 3 years), then reassessing the market and your options to switch or refix later.

Ready vs off-plan mortgages for expats

- Ready properties: highest LTVs (up to 80% for first homes), faster approvals, and immediate rental income potential if you will let the unit.

- Off-plan properties: capped at 50% LTV by regulation, and banks usually release funds at handover; until then, you’re paying the developer per your construction-linked plan. The upside is strong capital appreciation potential in early phases.

If you’re considering off-plan, West Gate can help you compare the city’s best launches and match them to bank policies. Explore current off-plan projects in Dubai curated by West Gate.

Investment strategy: leveraging your mortgage

For investors, Dubai’s rental market can support positive cash flow with the right unit and financing mix. The fundamentals to optimize:

- LTV and equity: the 60% LTV cap on investment units keeps leverage conservative. This lowers monthly payments and can make net yields more robust.

- Interest structure: consider a period of fixed rates to stabilize your cash flow while rents adjust, then reassess.

- Professional management: a well-managed property reduces vacancies, optimizes pricing, and keeps tenants longer.

If you prefer a hands-off investment, West Gate’s end-to-end Property Management keeps your asset occupied, maintained, and cash-flowing. If you’re still hunting for the right asset, browse properties for sale in Dubai or high-demand properties for rent to gauge the neighborhoods and unit types tenants prefer.

Step-by-step: the expat mortgage journey

- Get pre-approved. This clarifies your budget and signals seriousness to sellers.

- Choose the property and sign the MOU (or SPA for off-plan).

- Bank valuation and final approval.

- Pay DLD fees and complete trustee transfer.

- Register the mortgage (0.25% of loan amount + AED 290 per DLD).

- Handover and, if investing, list your unit for rent.

West Gate can orchestrate each step and present bank offers that fit your profile. If you’d like tailored options, just leave your details and our team will call you to discuss all the numbers. Fill the form here and a professional agent will contact you.

Smart ways to lower your rate and increase approval odds

- Improve DBR by clearing small debts and lowering credit card limits before applying.

- Consider salary transfer to your chosen bank; it can unlock better pricing.

- Put down a higher deposit to lower LTV; better equity can earn you a lower margin.

- Provide complete documents from day one; clean, verifiable files speed approvals.

Common questions expats ask in 2025

Can I get 85% LTV as an expat?

No. The 85% cap is reserved for UAE nationals under the current Central Bank regs. For expats, first-home LTV is up to 80% (≤ AED 5m) or 70% (> AED 5m) per the CBUAE Rulebook.

What if I’m a non-resident?

Many banks will lend up to around 50% LTV, with tighter criteria and rates, as seen in examples like ADCB.

What’s the maximum term?

Up to 25 years, per the CBUAE Rulebook.

How are rates set?

Variable rates are commonly EIBOR + a fixed bank margin; fixed rates apply for an initial period. You can check live EIBOR at the CBUAE.

What are the biggest fees at closing?

DLD transfer fee (4% of price in most transactions), DLD mortgage registration (0.25% of loan + AED 290), plus lender valuation and processing. See DLD and a fee overview by Engel & Völkers.

Helpful deep-dives on West Gate Dubai

For further reading directly related to financing, eligibility, and total cost planning, check out these popular guides on West Gate’s blog:

- Dubai Mortgage Advice for Expats

- Property Financing in Dubai

- Buy Property in Dubai: Guide

- What Are the Costs of Buying Property in Dubai?

- Off-Plan Properties in Dubai

These pieces expand on bank selection, timelines, total cash needed, and how to structure a purchase for both homeowners and investors.

Why work with West Gate Dubai in 2025

West Gate Dubai is a full-service brokerage and asset manager trusted by both first-time expat buyers and seasoned investors. We shortlist the best bank offers for your profile, negotiate terms with developers and sellers, and manage your unit post-handover to keep returns strong.

- Buying? See curated properties for sale.

- Investing for yield? Let our Property Management team maximize occupancy and NOI.

- Exploring the rental market? Gauge demand with properties for rent.

- Hunting the next launch? Browse off-plan projects.

“Dubai’s mortgage framework for expats is clear, stable, and investor-friendly—once you align your LTV, DBR, and rate structure, approvals move fast and ownership is straightforward.”

If you’d like a bank-by-bank comparison or a custom affordability plan, we have a lot more properties and finance options than what’s listed online—just fill out the form and a professional Agent will contact you with all the details.

Final word for 2025 buyers and investors

In 2025, expat mortgages in Dubai are defined by transparent Central Bank rules and a competitive banking market. Aim for the right LTV, keep your DBR under 50%, and choose a rate structure that fits your income visibility. Budget not only for your down payment but also for DLD and bank fees, and always compare the reversion formula behind any “teaser” fixed rate. With a clear plan and a strong advisory partner, you can secure the right home or investment and let the city’s world-class rental demand and infrastructure do the rest.

When you’re ready, West Gate will coordinate your pre-approval, shortlisting, negotiation, transfer, and—if you’re investing—professional management to keep your asset performing. Start the conversation here.